Options Selling - How I almost make profits

Selling Index Options, and attempts to back up strategies with data

Markets, am I right?

I personally do not think I can ever accurately predict if the markets are going to go up or down or stay neutral. Moreover, I can also not trust the trends when it does indeed go on a bull run or a bear run. Partly its my cowardice. Partly it is the hundreds of conflicting signals that leads to markets changing.

But if there’s few indicators that I do look out for - or rather only believe in - is Technical Analysis (TA). It comes with its own astrology like beliefs that I can’t just trust blindly.

Following Abid Hassan’s Kya Lag Raha Hai Market, I can at least find some guiding light in this sea of chaos.

My goto strategy - Short Strangle on Index

While I tried different strategies, and found myself in crazier unexpected times - sudden increase in VIX and market going on an unannounced run, etc; I decided to finally focus all my might into the `Short Strangle` strategy.

A short strangle consists of one short call with a higher strike price and one short put with a lower strike.

Pros:

High Probability of Profit: The stock has to make a big move in either direction for you to shit your pants. As these are OTM options, the bet is that the premiums dry up and reduce to 0 and you take the money home

Positive Theta: Time decay, as the options get closer to expiration, their value decreases, potentially increasing your profit if other factors remain constant.

Flexible Adjustments: If the stock moves against you, there are several ways to adjust the trade, such as rolling the strangle or converting it into an iron condor.

Cons:

Volatility Spikes: An increase in implied volatility will inflate the option premiums, potentially causing a loss even if the stock hasn't moved against you.

Capital Intensive: You are selling options, there’s no way to put it but to make minor amounts of money you need major amounts of capital (margin)

Management Intensive: Given the risk, you need to keep a close eye on these positions. Any significant news event can blow up the trade.

Unlimited Risk: The biggest drawback. If the stock makes a significant move, you could face unlimited losses on the call side and substantial losses up to the strike price of the put. More over, the losses are unrealized, leaving you in panic & making you more hopeful than rational - you either square off and realize the huge losses or you fix it in haste (and then the market “reverts to the mean”)

Risk/Reward Trade-off of Short Strangles

The strategy has a high probability of a small gain and a low probability of a large loss. It's akin to picking up coins on a railway track. You win more often, but when you lose, it can be devastating if not managed well.

Data Science Upbringing

Working with data, and finding patterns, and believing in certain things like reversion to the mean I started identifying what the ideal strategy could be.

And the strategy is - market doesn’t move much in a day or in a week. It is range bound. Let’s go through this!

Analysis 1 - How much does the market move after hours?

Make trades at 3 / 315 PM to square off with the theta decay the next morning ?

This is helpful when you want to get the theta by leaving your positions over night. I remember times when there’s so many Indian, US & global events - international tensions, recession, inflation, rates hikes - all of that translating into waking up to a VIX spike and your positions going haywire. It's like a bad hangover, except it's your portfolio that's hurting, not just your head.

Is it then a good strategy? Not worth it if you want to only scrape the theta and square off positions the next day. I no longer leave positions overnight, unless the trades are meant to be of weekly nature. The stress is not worth this.

Analysis 2 - How much does the market change within the day?

Day Trading Short Strangles

The idea is - safer 9:20 straddle. If I don’t know where the market is going to go to, and I believe most of the movements in the market already happen with during off hours, with some data around overall trend happening (Open Interest, FII, DII data), how volatile is the market going to really be throughout the day; this should work, right?

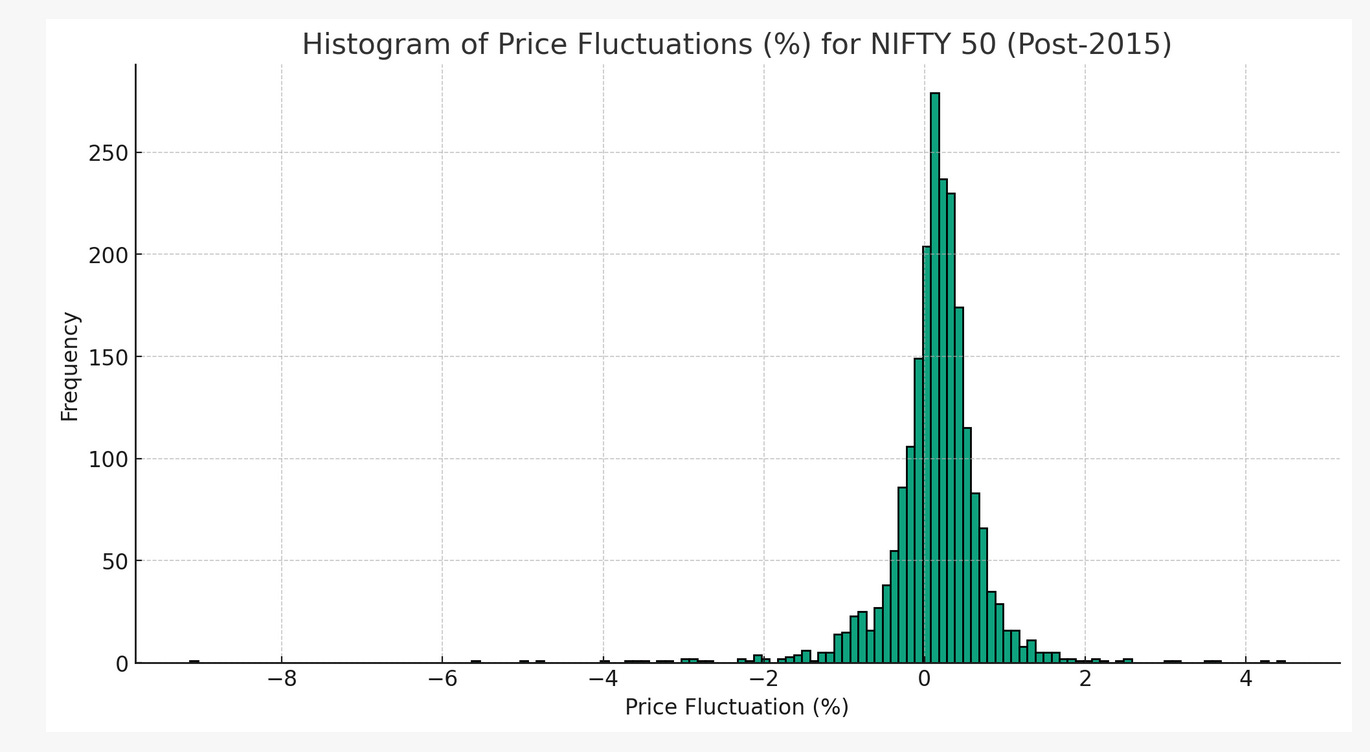

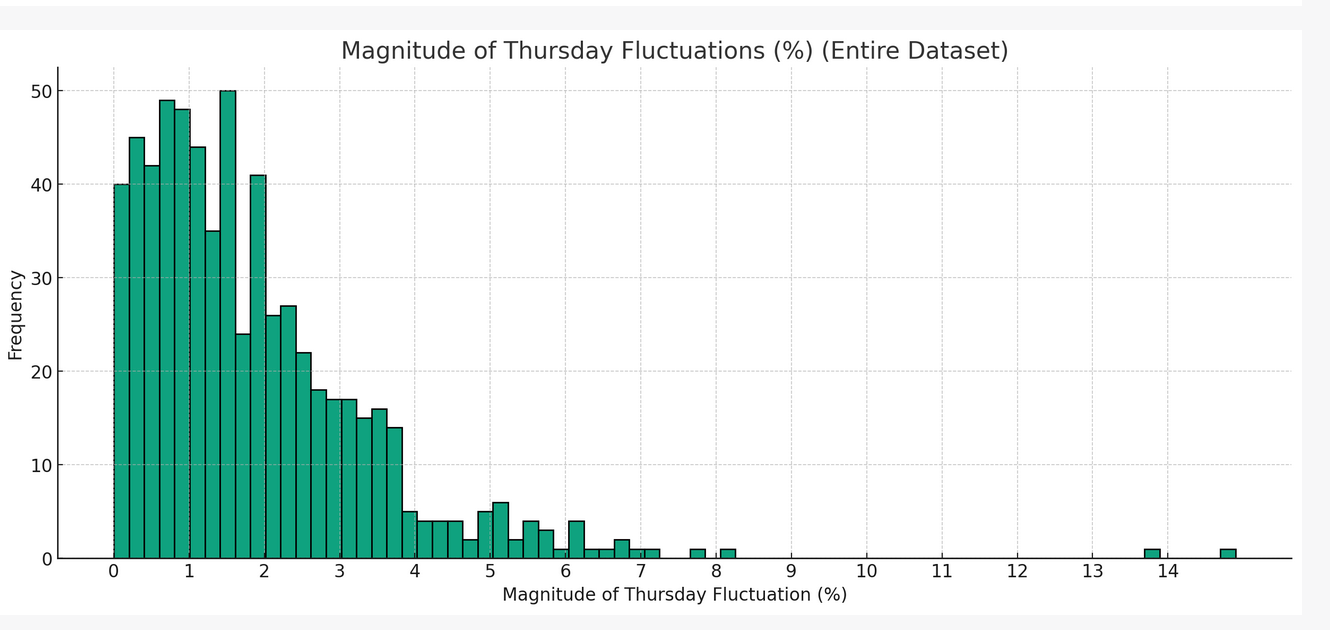

These histograms help me build up the conviction that the market wouldn’t move that much most of the days in the year. Do remember that bigger the range, more the probability of a successful trade and worse the gains. So have to take enough risk to get decent returns yet not leaving one self vulnerable to the shortcomings of short strangle.

Majority of the data points are clustered around lower magnitudes, which can be interpreted as lower intraday volatility. But again, one wrong trade and your weeks of gains wipe off and more.

This is exactly what happened in the month of July for me, I was able to make approximately ~7.3 % in that month, and all it took was 1 trade to wipe away all the gains and leave me with a minor loss. So its not always perfect and I am still evaluating if it is worth all the hassle.

At the very least my broker is happy with me doing this.

Analysis 3 - How much does the market move week to week?

Do I really need to be that conservative and square my positions off daily or just do weekly trades with corrections?

Funny enough, I did actually start with trades that were open for week(s). And it did pay off decently. Just that the unrealized nature of losses that look extreme and my inability to predict markets had me move to a routine of leaving trades open at max for a few days now. And it does work well (untill it doesn’t).

But correcting the trades before them going wrong is something that I have to learn next.

Do share your feedback or share with me what could help me improve.

Notes

I have used NIFTY data from 20 August 2010 to 24 August 2023

Analysis was done for ranges of dates from 2015 to 2023 and 2010 to 2023. Also worked on rolling windows of timeframes of 2 / 5 years; general patterns are consistent with the exception of extreme fluctuations

While my trading started off with the attempt to make passive income, It does take a toll on my stress levels when I have set goals and expectations.

I plan to continue to gamble as long as

I do not lose sleep or sweat during the day

Its fun and bit rewarding (money and knowledge wise)

I do not take much stress

Do at least as much as my mutual fund portfolio

Is still passive in nature - do not spend hours of times in a day

!["I [suspect] that we are throwing more and more of our resources, including the cream of our youth, into financial activities remote from the production of goods and services, into activities that generate high private rewards disproportionate to their social productivity. I suspect that the immense power of the computer is being harnessed to this 'paper economy', not to do the same transactions more economically but to balloon the quantity and variety of financial exchanges." --James Tobin, July 1984 "I [suspect] that we are throwing more and more of our resources, including the cream of our youth, into financial activities remote from the production of goods and services, into activities that generate high private rewards disproportionate to their social productivity. I suspect that the immense power of the computer is being harnessed to this 'paper economy', not to do the same transactions more economically but to balloon the quantity and variety of financial exchanges." --James Tobin, July 1984](https://substackcdn.com/image/fetch/$s_!07pZ!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fe120e424-ca93-482f-ba8c-403fa23444d4_740x277.png)